Innovative Renovation Strategies

Designing Wealth: How Innovative Renovation Strategies Fuel Property Flipping Success Property flipping has become an increasingly popular investment strategy in Australia, and for good reason.

Designing Wealth: How Innovative Renovation Strategies Fuel Property Flipping Success Property flipping has become an increasingly popular investment strategy in Australia, and for good reason.

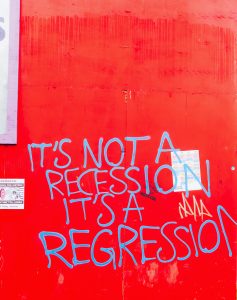

Due to recent global events that led to a decline in the Housing Market, clients would come up to us and ask ‘How does

Stop Paying More For Being Loyal, Avoid Paying the Loyalty Tax! We are all taught that businesses should reward their most loyal customers.

An easier way to Apply for a Self Employed Home Loan (As Long As You Get Paid A Salary). One of the most difficult

Understanding Lender’s Mortgage Insurance Policies As a rule, if you don’t have a 20% deposit in savings, then your bank will ask you to pay

When Was The Last Time You Checked Your Self Managed Super Fund Investment Loans? I was on a webinar the other day and the host

The Latitude Data ‘Breach’ Definitely Left its Mark – so I want to lay down tips on How to Keep Your Data Safe. The scale

Are you looking to refinance your home loan? For some, there are easy ways to get the result they are looking for without refinancing. As

In April the Federal government announced First Home Guarantee Scheme Changes. From July 1 2023, friends, siblings and other family members will be able to

This Is Getting Out Of Hand And A Small Glimmer Of Good News – Why are Interest Rates so High in Australia? Why are Interest

Discover the 9-step process of buying a house in NSW and gain valuable insights into navigating the real estate market. From assessing borrowing capacity to settling the purchase, this comprehensive guide covers everything you need to know. Don’t miss out on essential steps like property inspections, contract review, financing, and more. Get expert advice for a smooth and successful home buying journey.

Recently we were helping a client buy a property in an Over-55 Complex – I don’t think they understood just how difficult home loans like

© Mortgage World Australia Pty Ltd ABN 65 653 284 433 ACR 396946 | Privacy • Terms • Disclaimer

Mortgage World Australia Pty Ltd